Dutch Bros Inc.

Dutch Bros Inc. to be held on June 1, 2022, at 11:00 a.m. Pacific Time.•Blocker Companies means certain Pre-IPO Dutch Bros OpCo Unitholders that are taxable as corporations for U.S. federal income tax purposes.

•Board or Board of Directors refers to the Board of Directors of Dutch Bros Inc.

•Class A common stock means Class A Common Stock, par value $0.00001 per share, of Dutch Bros Inc.

•Class B common stock means Class B Common Stock, par value $0.00001 per share, of Dutch Bros Inc.

•Class C common stock means Class C Common Stock, par value $0.00001 per share, of Dutch Bros Inc.

•Class D common stock means Class D Common Stock, par value $0.00001 per share, of Dutch Bros Inc.

•Class A common units means non-voting Class A Common Units of Dutch Bros OpCo, as defined in the Third LLC Agreement.

•Class B voting units means Class B Voting Units of Dutch Bros OpCo, as defined in the Third LLC Agreement.

•Class C voting units means Class C Voting Units of Dutch Bros OpCo, as defined in the Third LLC Agreement.

•Co-Founder refers to Travis Boersma and affiliated entities over which he maintains voting control.

•Common Units means Common Units of Dutch Bros OpCo, as defined in the Second Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo, dated as of January 22, 2019.

•Continuing Members refers to the Co-Founder and the Sponsor.

•Dutch Bros OpCo refers to Dutch Mafia, LLC, a Delaware limited liability company and direct subsidiary of Dutch Bros Inc.

•Dutch Bros OpCo Units refers to Class A common units, Class B voting units and Class C voting units of Dutch Bros OpCo, each as further defined in the Third LLC Agreement, collectively.

•Dutch Bros Tax Group refers to Dutch Bros Inc. or any member of its affiliated, consolidated, combined, or unitary tax group.

•Exchange Act refers to the Securities Act of 1934, as amended.

•Exchange Tax Receivable Agreement means the Tax Receivable Agreement (Exchanges) entered into by Dutch Bros Inc. with the Continuing Members, dated as of September 14, 2021.

•FASB refers to the Financial Accounting Standards Board.

•IPO refers to our initial public offering of shares of Class A common stock.

•Pre-IPO Blocker Holders refers to TSG7 A AIV VI Holdings-A, L.P. and DG Coinvestor Blocker Aggregator, L.P. or their assignees or successors pursuant to the terms of the certain Reorganization Tax Receivable Agreement.

•Pre-IPO Dutch Bros OpCo Unitholders means individuals and/or entities that held Common Units and/or Profits Interest Units immediately prior to the Reorganization Transactions.

Dutch Bros Inc.| 2022 2024 Proxy Statement | 5

GLOSSARY(continued)

| | | | | | | | |

| TERM | | DEFINITION |

| Pre-IPO Blocker Holders | | TSG7 A AIV VI Holdings-A, L.P. and DG Coinvestor Blocker Aggregator, L.P. or their assignees or successors pursuant to the terms of the Reorganization Tax Receivable Agreement. |

| Pre-IPO Dutch Bros OpCo Unitholders | | Individuals and/or entities that held Common Units and/or Profits Interest Units immediately prior to the Reorganization Transactions. |

| Profits Interest Units and PIUs | | PI Units of Dutch Bros OpCo, issued and outstanding immediately prior to the Reorganization Transactions. |

•Profits Interest Units and PIUs refer to PI Units of Dutch Bros OpCo, issued and outstanding immediately prior to the Reorganization Transactions.

•Record Date means April 7, 2022.

•Registration Right Agreement means the| Record Date | | March 19, 2024. |

| QSR | | Quick Service Restaurant. |

| Registration Rights Agreement | | The Amended and Restated Registration Rights Agreement entered into by Dutch Bros Inc. with the Continuing Members, dated as of October 31, 2023. |

| Reorganization Tax Receivable Agreement | | Tax Receivable Agreement (Reorganization) entered into by Dutch Bros with the Pre-IPO Blocker Holders, dated as of September 14, 2021. |

| Reorganization Transactions | | The transaction to implement our “Up-C” structure undertaken in connection with our IPO, as further described in our prospectus, filed pursuant to Rule 424(b)(4), (Registration No. 333- 258988) on September 14, 2021. |

| RSA | | Restricted Stock Awards. |

| RSU | | Restricted Stock Units. |

| | |

| SEC | | United States Securities and Exchange Commission. |

| Securities Act | | The Securities Act of 1933, as amended. |

| Sponsor | | TSG Consumer Partners, L.P. and certain of its affiliates. |

| Stockholders Agreement | | Stockholders Agreement of Dutch Bros Inc., dated as of September 17, 2021. |

| Tax Receivable Agreements and TRAs | | The Exchange Tax Receivable Agreement and the Reorganization Tax Receivable Agreement. |

| Third LLC Agreement | | Third Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo, dated as of September 14, 2021. |

| | |

Dutch Bros Inc.

Dutch Bros Inc. with the Continuing Members, dated as of September 17, 2021.•Reorganization Tax Receivable Agreement means the Tax Receivable Agreement (Reorganization) entered into by Dutch Bros with the Pre-IPO Blocker Holders, dated as of September 14, 2021.

•Reorganization Transactions means the transaction to implement our “Up-C” structure undertaken in connection with our IPO, as further described in our prospectus, filed pursuant to Rule 424(b)(4), (Registration No. 333- 258988) on September 14, 2021.

•RSA refers to restricted stock award.

•RSU refers to restricted stock unit.

•SEC refers to the United States Securities and Exchange Commission.

•Securities Act refers to the Securities Act of 1933, as amended.

•Sponsor refers to TSG Consumer Partners, L.P. and certain of its affiliates.

•Stockholders Agreement means the Stockholders Agreement of Dutch Bros Inc., dated as of September 17, 2021.

•Tax Receivable Agreements means the Exchange Tax Receivable Agreement and the Reorganization Tax Receivable Agreement.

•Third LLC Agreement means the Third Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo, dated as of September 14, 2021.

Dutch Bros Inc.| 2022 2024 Proxy Statement | 6

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Although we encourage you to read this proxy statement in its entirety, we include this Q&A section to provide some background information and brief answers to several questions you might have about the Annual Meeting.

Q: Why are we providing these materials?

A: These materials are provided to you in connection with our Annual Meeting, which will take place on Wednesday, June 1, 2022,Tuesday, May 14, 2024, at 11:2:00 a.m.p.m. Pacific Time. Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials because our Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. Stockholders are invited to participate in the Annual Meeting and are requested to vote on the proposals described herein.

We intend to mail the Notice of Internet Availability of Proxy Materials on or about April 21, 2022,1, 2024, to all stockholders of record entitled to vote at the Annual Meeting.

Q: How do I attend the Annual Meeting?

A: In order to facilitate stockholder participation, in the Annual Meeting and in light of public health concerns regarding the COVID-19 pandemic and to protect the health and safety of our stockholders and employees, the Annual Meeting will be held through a live webcast. You will not be able to attend the annual meeting in person. You, or your valid designated proxy, are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on April 7, 2022,March 19, 2024, the Record Date. To be admitted to the Annual Meeting virtually, you will need to visit www.virtualshareholdermeeting.com/BROS2022BROS2024 and enter the 16-digit Control Number found next to the label “Control Number” on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form (if you received a printed copy of the proxy materials), or in the email sending you the Proxy. If you are a beneficial stockholder, you should contact the bank, broker, or other institution where you hold your account in advance of the meeting if you have questions about obtaining your control number/proxy to vote.

Please note, virtual participation in the Annual Meeting is limited due to the capacity of the host platform. Access to the Annual Meeting will be accepted on a first come, first served basis, so we encourage you to log into the virtual meeting site in advance of the start time of the Annual Meeting. Online check-in will start approximately thirty (30) minutes before the meeting June 1, 2022May 14, 2024 at 11:2:00 a.m.p.m. Pacific Time.

Whether or not you participate in the Annual Meeting, it is important that you vote your shares. We recommend that you submit your proxy card or voting instructions in advance of the Annual Meeting so that your vote will be counted even if you decide not to participate in the Annual Meeting. See below under “Q.“Q: How do I submit my vote?” for detailed instructions on how to submit your vote.

Q: Who can vote at the Annual Meeting?

A: Only stockholders of record at the close of business on the Record Date (April 7, 2022)(March 19, 2024), will be entitled to vote at the Annual Meeting. On the Record Date, there were 39,556,90978,570,922 shares of Class A common stock outstanding and entitled to vote, 64,699,13660,071,226 shares of Class B common stock outstanding and entitled to vote, 45,385,63629,868,545 shares of Class C common stock outstanding and entitled to vote, and 14,061,8178,664,225 shares of Class D common stock outstanding and entitled to vote. Subsequent to the Record Date, our Sponsor exchanged 5,989,078 shares of Class C common stock (together with the corresponding Class A common units) and converted 2,010,922 shares of Class D common stock into shares of Class A common stock which were sold in the Offering. Upon the closing of the Offering on March 26, 2024, there were 86,570,922 shares of Class A common stock outstanding, 60,071,226 shares of Class B common stock outstanding, 23,879,467 shares of Class C common stock outstanding, and

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 7

Q.6,653,303 shares of Class D common stock outstanding. Notwithstanding the Offering, pursuant to our amended and restated bylaws and the Delaware General Corporation Law, the stockholders are entitled to vote the number of shares outstanding on the Record Date.

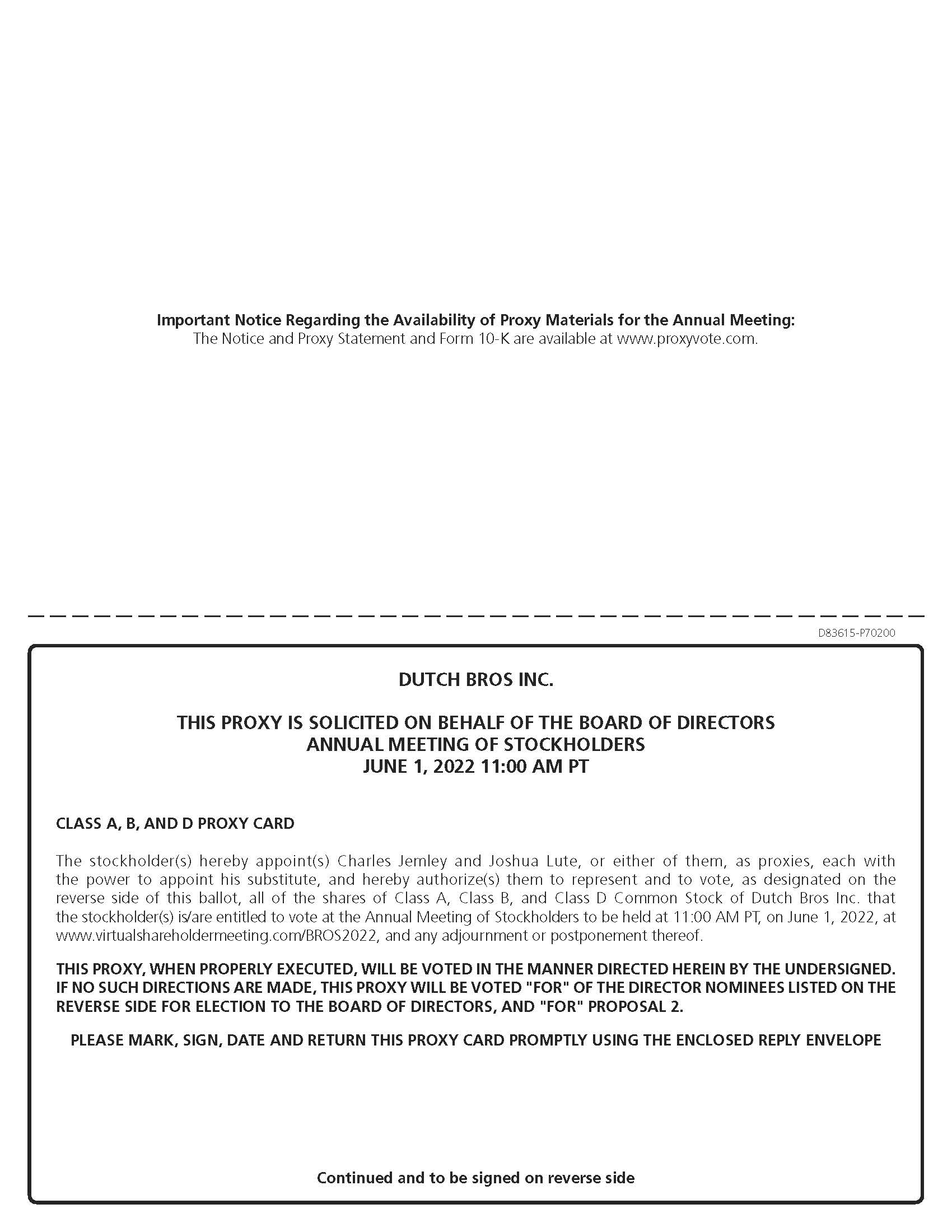

Q: How do I submit my vote?

A: You may vote “For” or “Against” or abstain from voting for each of the nominees to the Board on which you are entitled to vote on.vote. For eachthe ratification of the other matters to be votedappointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024, you may vote “For” or “Against” or abstain from voting. For the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, you may vote “For” or “Against” or abstain from voting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy card or voting instructions prior to the Annual Meeting so that your vote will be counted if you later decide not to attend the Annual Meeting.

Voting Prior to the Annual Meeting:

To vote prior to the Annual Meeting until 8:59 p.m. Pacific Time on May 31, 2022,13, 2024, you may vote via the internet at www.proxyvote.com; by telephone; or by completing and returning your proxy card or voting instruction form, as described below:

• To vote using the proxy card, simply complete, sign and date the proxy card that you receive with your proxy materials and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

• To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the 16-digit Control Number provided to you on your Notice of Internet Availability of Proxy Materials that you received for the Annual Meeting. Your telephone vote must be received by until 8:59 p.m. Pacific Time on May 31, 2022,13, 2024, to be counted.

• To vote through the internet prior to the Annual Meeting, go to www.proxyvote.com and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide the 16-digit Control Number provided to you on your Notice of Internet Availability of Proxy Materials that you received for the Annual Meeting. For your vote to be counted in advance of the Annual Meeting, your internet vote must be received by until 8:59 p.m. Pacific Time on May 31, 2022.13, 2024.

Voting During the Annual Meeting:

To vote during the Annual Meeting, if you are a registered stockholder as of the Record Date and attending virtually, follow the instructions at www.virtualshareholdermeeting.com/BROS2022.BROS2024. You will need to enter the 16-digit Control Number found on your Notice of Internet Availability of Proxy Materials or notice you receive or in the email sending you the Proxy.

Q: What if I cannot find my Control Number?

A: If you cannot find your Control Number and you are the registered stockholder, please call the number listed on your Notice of Internet Availability of Proxy Materials. If you cannot find your Control Number and you are a beneficial stockholder, you may contact the bank, broker, or other institution where you hold your account if you have questions about obtaining your control number prior to the Annual Meeting. If you are unable to locate your 16-digit control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting.

Q: Will a list of stockholders of record as of the Record Date be available?

A: A list of our stockholders of record as of the close of business on the Record Date will be made available to stockholders for inspection during the meeting at www.virtualshareholdermeeting.com/BROS2022. In addition, the list will be available for the ten days prior to the Annual Meeting at our headquarters at 110 SW 4th Street, Grants Pass, Oregon 97526. If you would like to view the list for a legally valid purpose, please contact us to schedule an appointment during ordinary business hours by emailing investors@dutchbros.com.

Dutch Bros Inc.| 2024 Proxy Statement | 8

Dutch Bros Inc.| 2024 Proxy Statement | 8

Q: Where can we get technical assistance?

A: If you have difficulty accessing the Annual Meeting, please call the number listed on the stockholder login page at www.virtualshareholdermeeting.com/BROS2022,BROS2024, where technicians will be available to help you.

Dutch Bros Inc.| 2022 Proxy Statement | 8

Q: For the Annual Meeting, how do we ask questions of management and the Board?

A: We plan to have a Q&A session at the Annual Meeting and will include as many appropriate stockholder questions as the allotted time permits. Stockholders may submit questions that are relevant to ourthe business of the Annual Meeting in advance of the Annual Meeting as well as live during the Annual Meeting. If you are a stockholder, you may submit a question in advance of the meeting at www.proxyvote.com after logging in with your Control Number. Questions of virtual attendeesStockholders may be submittedsubmit questions during the Annual Meeting through www.virtualshareholdermeeting.com/BROS2022.BROS2024.

Q: What information is contained in this Proxy?

A: This Proxy contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, and other required information.

Q: What proposals will be voted on at the Annual Meeting?

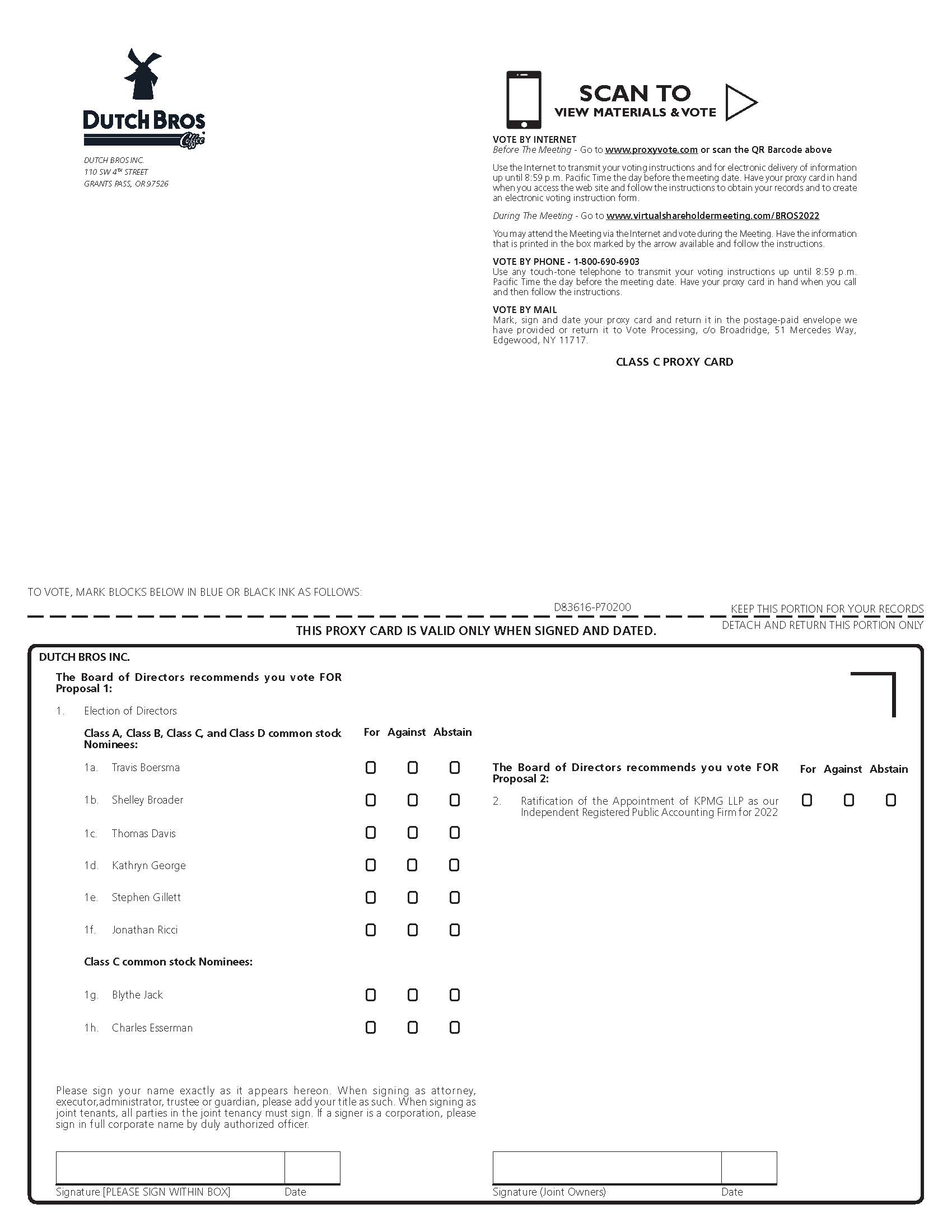

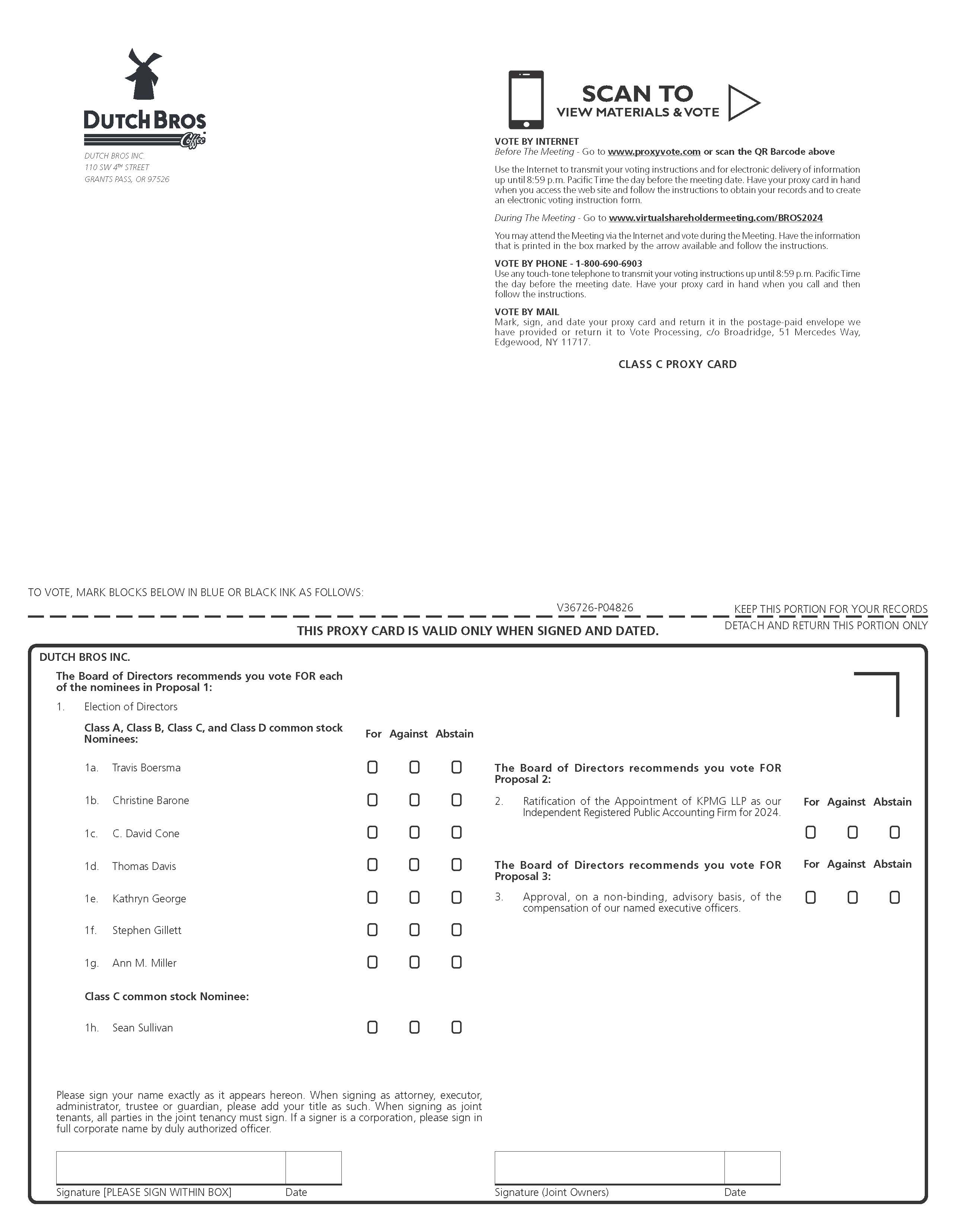

A: There are twothree proposals scheduled to be voted on at the Annual Meeting:

• election of eight director nominees, sixseven of whom will be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, and twoone of whom will be elected by the holders of our Class C common stock, voting as a separate class, each to serve until our 20232025 annual meeting of stockholders; and

• ratification of the selectionappointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024; and

• approval, on a non-binding, advisory basis, of the compensation of our named executive officers.

We will also consider other business that properly comes before the Annual Meeting.

Q: How does the Board recommend that I vote?

A: The Board recommends that you vote your shares “FOR” the election of each of the Board’s nominees.

The Board recommends that you vote your shares “FOR” the ratification of selectionthe appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024.

The Board recommends that you vote your shares “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers.

Q: What shares can I vote?

A: You may vote all shares of common stock that you owned as of the close of business on the Record Date (April 7, 2022)(March 19, 2024).

The holders of Class A common stock, Class B common stock, Class C common stock, and Class D common stock vote together as a single class, other than for the election of two directors designated by our Sponsor,one director, where the holders of Class C common stock will vote as a separate class (in accordance with our amended and restated certificate of incorporation and our Stockholders Agreement, as described herein in the section titled “Transactions“Other Matters—Transactions with Related Persons—Stockholders Agreement”).

You have one vote for each share of Class A common stock, ten votes for each share of Class B common stock, three votes for each share of Class C common stock, and three votes for each share of Class D common stock you owned as of the Record Date (April 7, 2022)(March 19, 2024). Holders of outstanding shares of our

Dutch Bros Inc.| 2024 Proxy Statement | 9

Dutch Bros Inc.| 2024 Proxy Statement | 9

Class A common stock, Class B common stock, Class C common stock, and Class D common stock will vote as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law or pursuant to the terms of our amended and restated certificate of incorporation. As of the Record Date (April 7, 2022)(March 19, 2024), there were 39,556,90978,570,922 shares of Class A common stock outstanding, 64,699,13660,071,226 shares of Class B common stock outstanding, 45,385,63629,868,545 shares of Class C common stock outstanding, and 14,061,8178,664,225 shares of Class D common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

Dutch Bros Inc.| 2022 Proxy Statement | 9

Q: What is the difference between being a registered stockholder and a beneficial owner?

A: Many of our stockholders hold their shares through stockbrokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a registered stockholder and a beneficial owner.

Registered Stockholder: If your shares are registered directly in your name with our transfer agent, American Stock Transfer &Equiniti Trust Company, LLC, you are the registered stockholder, and these proxy materials are being sent directly to you. As the registered stockholder, you have the right to grant your voting proxy directly to us and to vote at the Annual Meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or other nominee, who is considered to be the registered stockholder. As the beneficial owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the registered stockholder, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy from your nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote. You may vote by following those instructions and the instructions on the Notice of Internet Availability of Proxy Materials.

Q: Can I change my vote or revoke my proxy?

A: Yes, you can change your proxy instructions at any time before the vote at the Annual Meeting, by:

ForRegistered Stockholders: Shares RegisteredStockholders (shares registered in your own name:name):

• Entering a new vote online;

• Entering a new vote by telephone;

• Mailing a written notice of revocation to our Corporate Secretary at our address below, or

• Signing and returning a new proxy card bearing a later date, which will automatically revoke your earlier proxy instructions.

For Beneficial Owners: Shares RegisteredOwners (shares registered in the Namename of Brokerbroker or Bank:bank):

•If your shares are held by your broker, bank, or other agent,nominee, you should follow the instructions provided by your broker, bank, or other agent.nominee.

Q: What constitutes a quorum?

A: A quorum of stockholders is necessary to hold a valid meeting. The holders of a majority of the voting power of the outstanding shares of stock as of the Record Date who are entitled to vote at the Annual Meeting and present in person, by remote communication, or represented by proxy duly authorized at the Annual Meeting, shall constitute a quorum. Votes withheld, abstentions,Abstentions and broker non-votes (as described below) are counted as present for the purpose of determining a quorum. As of the Record Date (April 7, 2022)(March 19, 2024), there were 39,556,90978,570,922 shares of Class A common stock outstanding, with one vote per share, 64,699,13660,071,226 shares of Class B common stock outstanding, with ten votes per share, 45,385,63629,868,545 shares of Class C

Dutch Bros Inc.| 2024 Proxy Statement | 10

Dutch Bros Inc.| 2024 Proxy Statement | 10

common stock outstanding, with three votes per share, and 14,061,8178,664,225 shares of Class D common stock outstanding, with three votes per share, all of which are entitled to be voted at the Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority (in voting power) of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

Dutch Bros Inc.| 2022 Proxy Statement | 10

Q: What is a broker non-vote?

A: If you hold shares beneficially in street name and do not provide your broker with specific voting instructions, your shares may constitute “broker nonvotes.non-votes.” Under the rules of the New York Stock Exchange (NYSE), brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, ProposalProposals 1 isand 3 are considered to be “non-routine” under NYSE rules, meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2. Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without your specific instruction. Broker nonvotesnon-votes are counted for quorum purposes but not in counting votes cast for, or entitled to vote on, a proposal.

If you are a beneficial owner of shares held in street name, and you do not plan to attend the Annual Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank, or other agentnominee by the deadline provided in the materials you receive from your broker, bank, or other agent.nominee.

Q: What is a proxyholder?

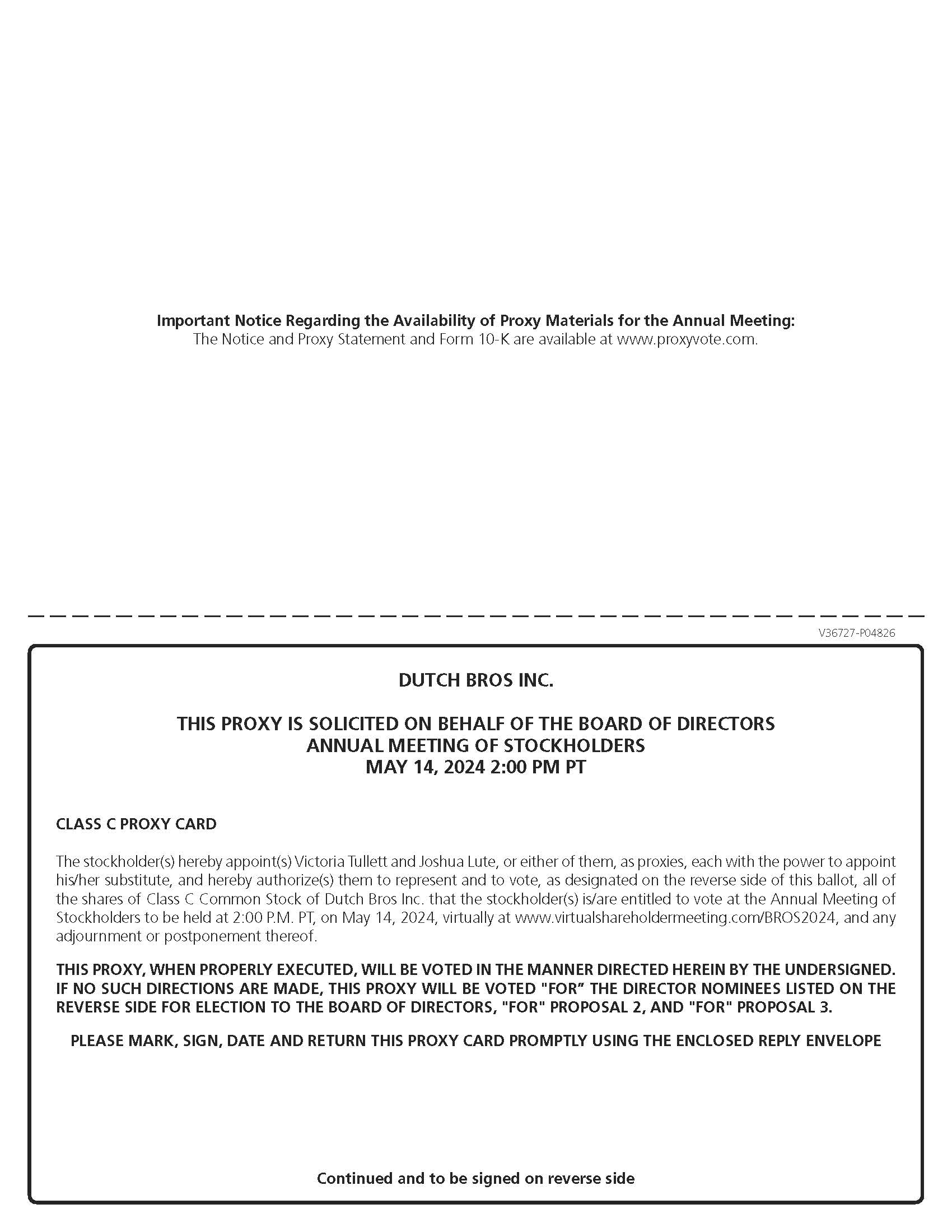

A: We are designating Charles Jemley,Victoria Tullett, our Chief FinancialLegal Officer and Corporate Secretary and Joshua Lute, our General CounselVice President of Employment and Franchise Law and Assistant Corporate Secretary, to hold and vote all properly-tendered proxies (except votes “withheld”).properly tendered proxies. If you have indicated a vote, they will so vote. If you have left a vote blank, they will vote as the Board recommends.

While we do not expect any other business to come up for vote, if it does, they will vote in their discretion. If a director nominee is unwilling or unable to serve, the proxyholders will vote in their discretion for an alternative nominee.

Q: What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

A: You may receive more than one Notice of Internet Availability of Proxy Materials, if, for example, you hold your shares in more than one name or in different brokerage accounts. You must vote based on the instructions in each Notice of Internet Availability of Proxy Materials separately.

Q: How are votes counted?

A: Broadridge Financial Solutions, Inc., has been appointed to be the inspector of elections, to act at the meeting, to make a written report thereof, to take charge of the polls, and to make a certificate of the result of the vote taken.

Eight director nominees are to be elected at the Annual Meeting. The holders of Class C common stock, voting as a separate class, are entitled to elect one member of the Board. The holders of Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, are entitled to elect six members of the Board. The holders of Class C common stock, voting as a separate class, are entitled to elect tworemaining members of the Board. Our stockholders do not have any right to vote cumulatively in any election of directors. Directors elected by the holders of the Class A common stock, Class B common stock, Class C common stock, and Class D common stock shall be electedmust

Dutch Bros Inc.| 2024 Proxy Statement | 11

Dutch Bros Inc.| 2024 Proxy Statement | 11

receive “For” votes from the holders of a majority of votes present virtually or represented by a plurality vote. This means that proxy and entitled to vote on the director nominees withmatter (i.e., the greatest number of votes cast even if less than“For” a majority, will be elected. Directorsnominee’s election must exceed the number of votes cast “Against” that nominee’s election). The director elected by the holders of Class C common stock shall be elected bymust receive “For” votes from the holders of a plurality votemajority of the votes of the Class C common stock.stock votes present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have no effect.

To be approved, Proposal No. 2, ratification of selectionthe appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022,2024, must receive “For” votes from the holders of a majority of votes present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote.

Dutch Bros Inc.| 2022 Proxy Statement | 11

To be approved, Proposal No. 3, approval, on a non-binding, advisory basis, of the compensation of our named executive officers, must receive “For” votes from the holders of a majority of votes present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote.We will announce preliminary results at the meeting and publish final voting results on a Current Report on Form 8-K that we expect to file with the SEC within four business days after the end of the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Q: Is my vote confidential?

A: Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within Dutch Bros or to third parties, except as necessary (i) to meet applicable legal requirements, (ii) to allow for tabulation and certification of the vote, and (iii) to facilitate successful proxy solicitation by the Board.

Q: Who bears the cost of soliciting votes for the Annual Meeting?

A: We bear the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. The solicitation of proxies or votes may be made in person, by telephone, and by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for these solicitation activities. In addition, we may reimburse brokerages and other entities that represent beneficial owners for their expenses in forwarding solicitation materials to beneficial owners.

Q: How can I submit a stockholder proposal or director nomination for next year’s annual meeting?

A: Stockholders may present proper proposals for inclusion in our proxy statement for next year and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner.

For a stockholder proposal or director nomination to be considered for inclusion in our proxy materials for next year’s annual meeting, our Corporate Secretary must receive the written proposal at our principal executive offices at the corporate address provided below not later than December 22, 2022.2, 2024. In the event that we hold next year’s annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting (i.e., before May 2, 2023,April 14, 2025, or after July 1, 2023)June 13, 2025), notice of a stockholder proposal must be received by our Corporate Secretary a reasonable time before we begin to print and send our proxy materials. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored proxy materials.

Dutch Bros Inc.| 2024 Proxy Statement | 12

Dutch Bros Inc.| 2024 Proxy Statement | 12

If a stockholder wishes to submit a nomination or proposal, which will not be included in our proxy materials, for consideration at next year's annual meeting, our amended and restated bylaws establish an advance notice procedure. Pursuant to our amended and restated bylaws, the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our Board, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for next year’s annual meeting, our Corporate Secretary must receive the written notice at our principal executive offices at the corporate address provided below:

•not earlier than the close of business on February 1, 2023January 14, 2025 (120 days before the anniversary of this year’s Annual Meeting); and

•not later than the close of business on March 3, 2023February 13, 2025 (90 days before the anniversary of this year’s Annual Meeting).

Dutch Bros Inc.| 2022 Proxy Statement | 12

In the event that we hold next year’s annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement next year must be received by our Corporate Secretary not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such annual meeting is first made.

If a stockholder who has notified us of his, her or itstheir intention to present a proposal at an annual meeting of stockholders does not appear to present his, her or itstheir proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

In addition to satisfying the foregoing requirements under our amended and restated bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than Dutch Bro’sBros’ nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 2, 2023.than March 15, 2025.

Q: Can I recommend director candidates directly to Dutch Bros?

A: Yes, our Board will consider director candidates recommended for nomination by our stockholders during such times as they are seeking proposed nominees to stand for election at the next annual meeting of stockholders (or, if applicable, a special meeting of stockholders). Our stockholders that wish to nominate a director for election to our board of directors should follow the procedures set forth in our amended and restated bylaws.

Q: Can I communicate with the Board?

A: Yes, any stockholder or other interested party may write to the Board at our address below or by email at investors@dutchbros.com.

Q: What is your corporate address for notice and Board communication purposes?

Dutch Bros Inc.

Attention: Corporate Secretary

110 SW 4th Street

Grants Pass, Oregon 97526

Q: What should I do if my household receives one copy of proxy materials and I need an additional copy?

A: We have adopted a procedure called "householding," which is approved by the SEC and permits the delivery of a single Notice of Internet Availability of Proxy Materials and, if applicable, one copy of the

Dutch Bros Inc.| 2024 Proxy Statement | 13

Dutch Bros Inc.| 2024 Proxy Statement | 13

proxy materials, to multiple stockholders sharing an address. Stockholders who participate in householding will continue to access and receive separate proxy cards. If one Notice of Internet Availability of Proxy Materials or set of other proxy materials is delivered to two or more stockholders who share an address, upon written or oral request we will promptly deliver a separate copy of such materials to a stockholder at a shared address. Please contact our agent using the information provided on the Notice of Internet Availability of Proxy Materials, or us at our offices at the address above, if you wish to receive a separate copy of any proxy materials, or if one household that is currently receiving multiple copies wishes to receive only a single copy of each of these documents for your household, please contact Broadridge Financial Solutions Inc. by calling their toll free number, 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, NY 11717, Attention: Householding Department. If in the future you wish to receive separate copies of our proxy materials, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at our office at the address above.

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 1314

BOARD OF DIRECTORS MATTERS

PROPOSAL 1: ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of our Board. We currently have eight directors with no vacancies. one vacancy following the resignation of Blythe Jack on March 22, 2024 in connection with the Offering and in accordance with our amended and restated certificate of incorporation and the Stockholders Agreement. Ms. Jack is not standing for re-election at the Annual Meeting. The Board thanks Ms. Jack for her guidance and dedicated service.

There are eight nominees for director this year, sixseven of whom will be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock, voting together as a single class, and twoone of whom will be elected by the holders of our Class C common stock, voting as a separate class. Directors are elected annually by a majority of eligible votes cast on each director’s election. As a result of Ms. Jack’s resignation, there will be one vacancy following the Annual Meeting. If you “Abstain” from voting, it will have no effect. This matter is non-routine, thus, if you hold your shares in street name, your broker may not vote your shares for you.

Our amended and restated certificate of incorporation and our amended and restated bylaws permit our Board to establish the authorized number of directors from time to time by resolution. Our amended and restated certificate of incorporation permits the holders of theour Class C common stock, voting as a separate class, to elect up to two members to the Board subject to certain limitations set forth therein. We have also entered into the Stockholders Agreement with investment funds affiliated with our Sponsor which provides that investment funds affiliated with our Sponsor will have the right to designate up to two of the directors serving on our Board. Subsequent to the Record Date, our Sponsor exchanged and sold 5,989,078 shares of Class C common stock (together with the corresponding Class A common units) and converted 2,010,922 shares of Class D common stock into shares of Class A common stock which were sold in the Offering. Upon the closing of the Offering, the total number of outstanding shares of the Class C common stock and Class D common stock was less than 50% of the total number of shares of our Class C common stock and Class D common stock outstanding immediately prior to the closing of our IPO. In accordance with our amended and restated certificate of incorporation, the holders of Class C common stock only be entitled to vote as a separate class on one director at the Annual Meeting notwithstanding the fact that the holders of Class C common stock are entitled to vote the number of shares of Class C common stock held by them and outstanding on the Record Date. See “Other Matters—Transactions with Related Persons—Stockholders Agreement.”

All of the directors were last elected as members of our Board prior toat our IPO,2023 annual meeting of stockholders, with the exception of Stephen GillettC. David Cone and Sean Sullivan, who were appointed to our Board in November 2023 to fill the vacancies created by the resignations of Shelley Broader and Charles Esserman, and Christine Barone, who was appointed to our Board in December 2021.January 2024 to fill the vacancy created by the resignation of Jonathan “Joth” Ricci. Each of the nominees listed below is currently a director of Dutch Bros. If elected at the Annual Meeting, each of these nominees would serve until the 20232025 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is Dutch Bros’ policy to encourage directors and nominees for director to attend the Annual Meeting. There was no annual meeting of stockholders in 2021. Vacancies and newly created directorships on the Board shallwill be filled as provided in the amended and restated certificate of incorporation, except as otherwise required by applicable law.

Dutch Bros Inc.| 2024 Proxy Statement | 15

Dutch Bros Inc.| 2024 Proxy Statement | 15

Vote Required

One of our directors is elected by the holders of Class C common stock and must receive “For” votes from the holders of a majority of Class C common stock votes present virtually or represented by proxy and entitled to vote on the matter. The remaining directors are elected by the holders of the Class A common stock, Class B common stock, Class C common stock, and Class D common stock and must receive “For” votes from the holders of a majority of the Class A common stock, Class B common stock, Class C common stock, and Class D common stock votes present virtually or represented by proxy and entitled to vote on the matter (i.e., the number of votes cast “For” a nominee’s election must exceed the number of votes cast “Against” that nominee’s election).

| | | | | | | | |

| | RECOMMENDATION OF THE BOARD |

| ☑ | | |

| The Board of Directors recommends that you vote “FOR” the election of each of the following director nominees for the class or classes of common stock that you hold. |

Dutch Bros Inc.| 2022 Proxy Statement | 14

Nominees to be elected by the holders of our Class A common stock, Class B common stock, Class C common stock, and Class D common stock:

| | | | | | | | | | | |

| | Travis Boersma Co-founder and Executive Chairman of the Board | Age: 51 53 |

| | |

| Skills & Expertise: •Industry Experience •Brand Marketing Experience •Operations & Distribution Experience •Senior Leadership Experience | Committees: None |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Boersma is our Co-Founder and has served as our Executive Chairman since August 2021 and as the Executive Chairman of Dutch Bros OpCo since February 2021. Prior to serving as our Executive Chairman, he served as the Chief Executive Officer of Dutch Bros OpCo from February 2019 to February 2021. Mr. Boersma has led us as Co-Founder since 1992. Mr. Boersma attended Southern Oregon University. We believe that Mr. Boersma’s experience as our co-Founder and his industry knowledge, as well as his leadership experience, make him an appropriate member of our Board.

Dutch Bros Inc.| 2024 Proxy Statement | 16

Dutch Bros Inc.| 2024 Proxy Statement | 16

| | | | | | | | | | | |

| | Jonathan “Joth” RicciChristine Barone

Chief Executive Officer President and Director | Age: 54 50 |

| | |

| Skills & Expertise: •Industry Experience •Brand Marketing Experience •Operations & Distribution Experience •Public Company Board Experience •Senior Leadership Experience | Committees: None |

| |

| Classes of Common Stock to Elect:Class A, B, C, and D common stock |

|

|

Mr. RicciMs. Barone has served as our Chief Executive Officer and President and a member of our Board since August 2021, the Chief Executive Officer of Dutch Bros OpCo since February 2021 and the President of Dutch Bros OpCo since January 2019. Since January 2020, Mr. Ricci has served as Chairman of the board of directors of Dutch Bros Foundation, our philanthropic arm. Since September 2020, he has served as a Council Member on the Racial Justice Council, an advisory committee formed by the State of Oregon. Since October 2019, he has served a member of the board of directors of Oregon Business Council, a nonprofit organization focused on civic engagement and public policy. Since February 2018, Mr. Ricci has served as a Steering Committee Founder of Taste For Equity, an annual fundraising and community-building event. Since June 2017, he has served as a member of the board of directors of Brew Dr. Kombucha, a beverage company. Since January 2013, he has served as a member of the advisory board of Ninkasi Brewing Company, an independent craft brewery. From April 2017 to January 2019, he served as President and Chief Executive Officer of Adelsheim Vineyard. From February 2013 to April 2017, Mr. Ricci served as President of Stumptown Coffee Roasters, a coffee company. From April 2010 to January 2013, he served as a Managing Partner of First Beverage Group, a venture capital, private equity and investment banking company specializing in the beverage industry. From January 2008 to April 2010, Mr. Ricci served as the Chief Executive Officer of Jones Soda Co., a beverage company (OTCMKTS: JSDA). Mr. Ricci received a B.S. in Business Education from Oregon State University. We believe Mr. Ricci’s leadership experience and knowledge of our industry make him an appropriate member of our Board.

Dutch Bros Inc.| 2022 Proxy Statement | 15

| | | | | | | | | | | |

| | Shelley Broader

Director

| Age: 57

|

| | |

| Skills & Expertise:

•Financial/Capital Allocation Experience

•Operations & Distribution Experience

•Public Company Board Experience

•Senior Leadership Experience

| Committees: Audit and Risk (Chair)

|

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock

|

|

|

Ms. Broader has served as a member of our Board since August 2021.January 2024, and as our President since February 2023. Ms. BroaderBarone has worked in the food service and beverage industries for more than a decade, and most recently served as Chief Executive Officer at True Food Kitchen, a high growth restaurant and President of Chico’s FAS, Inc., a fashion retailer,lifestyle brand, from December 2015August 2016 to April 2019.February 2023. Prior to this, Ms. Broaderthat, she served as Executive Vice President at Walmart Inc. (NYSE: WMT), a multinational retail company, from 2009 to November 2015 in various executiveleadership roles including as Presidentat Starbucks Corporation (Nasdaq: SBUX). Earlier in her career, she held positions with Bain & Company and Chief Executive Officer of the Walmart Europe, Middle East, and Sub-Saharan Africa region from July 2014 to October 2015, President and Chief Executive Officer of Walmart Canada Corp. from September 2011 to May 2014, Chief Merchandising Officer of Walmart Canada Corp. from 2010 to 2011, and Senior Vice President for Sam’s Club (a division of Walmart) from 2009 to 2010.Raymond James. Since March 2020, Ms. Broader previouslyBarone has served on the board of directors of Chico’s FAS, Inc. (NYSE: CHS) from December 2015 to April 2019 and Raymond James Financial, Inc. from February 2008 to February 2020. Ms. Broader is a member of the board of directors of Inspire Medical Systems, Inc. (NYSE: INSP), IFCO Systems, and the Moffitt Cancer Center’s National Board of Advisors.Directors of Yelp Inc. Ms. BroaderBarone holds a B.A. in Applied Mathematics and an M.B.A. from Washington StateHarvard University. We believe that Ms. Broader’s C-suiteBarone’s extensive leadership experience at a multitude of leading multinational brandsand expertise in our industry, operations, and brand marketing make her an appropriate member of our Board.

| | | | | | | | | | | |

| | Thomas Davis Director | Age: 44 46 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Compensation (Chair) |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Davis has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Since October 2012,January 2023, Mr. Davis has served as a Managing DirectorPartner of Brown Brothers Harriman & Co. (BBH), a privately owned financial services firm, where he oversees the New York, Latin America, and Chicago Private Banking offices.offices, and where he previously served as a Managing Director since October 2012. Mr. Davis also serves as a member of the Private Banking Oversight Committee and the Private Banking Investment Oversight Committee. From July 2007 to August 2012, he served as a Vice President in the Investment Management division of The Goldman Sachs Group, Inc., a publicly-traded global investment banking, securities, and investment management firm. Mr. Davis received an M.B.A. from the Mendoza College of Business at the University of Notre Dame and a B.B.A. from the University of San Diego. We believe that Mr. Davis’sDavis’ extensive leadership experience and expertise in strategy, finance, and management make him an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 1617

| | | | | | | | | | | |

| | Kathryn George Director | Age: 57 59 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Audit and RiskNone |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Ms. George has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Since January 1, 2008, Ms. George has served as a Partner of BBH, a privately owned financial services firm, where she has worked for 3537 years. Prior to assuming a leadership role in BBH’s Private Banking business in 2015, she had oversightserved as Chief Administrative Officer for over five years with responsibility for Global Audit, Enterprise Risk, Compliance, Human Resources, and the Office of General Counsel. Ms. George currently serves as Chair of the Private Banking Investment Oversight Committee, Co-Chair of the Global Inclusion Council, and as a member of the Private Banking Oversight Committee, the Capital Partners Investment and Valuation Committee, and the Governance Risk and Compliance Committee. She is also on the board of the BBHBrown Brothers Harriman Trust Company NA and the BBHBrown Brothers Harriman Trust Company (Cayman) Ltd.Limited. Since joining Brown Brothers Harriman & Co. in August 1986, she previously served in multiple positions, including Head of Merchant Banking and of Equity, Sales, Research, and Trading. Since September 2016, Ms. George has served as a member of the board of directors of Haven Behavioral Healthcare, Inc., a healthcare company. Since 2014, she has served as a trustee and member of the ExecutiveGovernance Committee of Trinity College, where she also serves as Chair of the Audit Committee.College. Since 2012, Ms. George has served as Chairman of the Board of Trustees of the Gillen Brewer School. She is a former Member of the Executive Committee of the Episcopal High School in Alexandria, Virginia, where she chaired the Investment Committee. Ms. George received a B.A. in Economics from Trinity College.College where she was elected to Phi Beta Kappa. We believe that Ms. George’s extensive leadership experience and expertise in strategy, finance, and management make her an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 1718

| | | | | | | | | | | |

| | Stephen Gillett Director | Age: 46 48 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Brand Marketing Experience •Operations & Distribution Experience •Technology Experience •Public Company Board Experience •Senior Leadership Experience | Committees: Audit and Risk (Chair), Nominating and Governance |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Mr. Gillett has served as a member of our Board since December 2021. Since December 2021,January 2023, Mr. Gillett has served as PresidentChief Executive Officer of Verily Life Sciences LLC (formerly, Google Life Sciences), a life sciences and technology company, where he haspreviously served as Chief Operating Officer sincefrom November 2020 to January 2023, and as Executive Advisor from May 2020 to November 2020. Since June 2019, Mr. Gillett has served as Advisor of X Development, LLC (formerly, GoogleX,GoogleX), a research and development company, and since December 2016, Mr. Gillett has served as an Advisor of GV (formerly, Google Ventures) a venture capital investment company. From September 2019 to May 2020, Mr. Gillett served as Executive Advisor to the CEO of Alphabet Inc. (NASDAQ: GOOGL, GOOG), a multinational technology conglomerate holding company, and its subsidiary, Google LLC. From March 2017 to October 2021, Mr. Gillett served as Chief Executive Officer of Chronicle, a cybersecurity company that he co-founded that was later acquired by Google Cloud in June 2019. Since June 2020, Mr. Gillett has served as a member of the board of directors of Discord Inc., a communication company focused on developing an online voice, video, and text communication platform, where he also serves as Chair of the Nominating and Governance Committee. From March 2015 to May 2017, Mr. Gillett served as a member of the board of directors of Chipotle Mexican Grill, Inc. (NYSE: CMG), a multinational fast casual restaurant company, where he also served as a member of the Audit and Nominating and Governance Committees. Mr. Gillett also served as member of the board of directors of Symantec Corporation from 2011 to 2012, a security software company prior to its acquisition by Broadcom Inc., where he also served as EVP, and Chief Operating Officer from December 2012 to July 2015 prior to its acquisition by Broadcom, Inc. Mr. Gillett received an M.B.A. from San Francisco State University and a B.S. from the University of Oregon. We believe that Mr. Gillett’s extensive leadership experience and expertise in technology, retail, strategy, and management make him an appropriate member of our Board.

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 1819

Nominees

| | | | | | | | | | | |

| | Ann M. Miller Director | Age: 49 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Brand Marketing Experience •Operations & Distribution Experience •Senior Leadership Experience | Committees: Nominating and Governance (Chair), Audit and Risk |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

Ms. Miller has served as a member of our Board since August 2022. Since February 2022, Ms. Miller has served as Executive Vice President and Chief Legal Officer of NIKE, Inc. (NYSE: NKE), a multinational athletic footwear, apparel, equipment, and services corporation. She has previously served for more than 15 years in various other roles at NIKE, most recently as Vice President, Corporate Secretary and Chief Ethics & Compliance Officer from November 2016 to February 2022. Ms. Miller is a practicing attorney and a member of the bar in New York, California, District of Columbia, and Oregon. She received a J.D. summa cum laude from University of Arizona College of Law and a B.A. in History from Smith College. We believe her extensive experience in advising public companies on business, securities, and corporate governance matters make her an appropriate member of our Board.

| | | | | | | | | | | |

| | C. David Cone Director | Age: 52 |

| | |

| Skills & Expertise: •Financial/Capital Allocation Experience •Senior Leadership Experience | Committees: Audit and Risk |

| |

| Classes of Common Stock to Elect: Class A, B, C, and D common stock |

|

|

C. David Cone has served as a member of our Board since November 2023. From October 2021 to December 2021, he served as Chief Financial Officer and Executive Vice President at Taylor Morrison Home Corporation (NYSE: TMHC), a residential homebuilding business and land developer. Prior to that, he held various roles at PetSmart, Inc. from 2003 to 2012, while the company was publicly-listed, most recently as Vice President, Finance Planning and Analysis. Mr. Cone previously served on the board of directors for Urbi Desarrollos Urbanos SAB DE CV. He received a B.A. in Business Economics with an emphasis in Accounting from the University of California at Santa Barbara. We believe Mr. Cone’s extensive experience in strategy, finance, and management, make him an appropriate member of our Board.

Dutch Bros Inc.| 2024 Proxy Statement | 20

Dutch Bros Inc.| 2024 Proxy Statement | 20

Nominee to be elected by the holders of our Class C common stock:

| | | | | | | | | | | |

| | Charles EssermanSean Sullivan

Director | Age: 6343 |

| | |

| Skills & Expertise: •IndustryBrand Marketing Experience •Public Company Board Experience •Senior Leadership Experience

| Committees:None |

| |

| Class of Common Stock to Elect: Class C common stock |

|

|

Mr. EssermanSean Sullivan has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Mr. Esserman serves as the Chief Executive Officer of TSG Consumer Partners, L.P., a private equity firm specializing in the consumer products industry that he co-founded in 1986, where he also serves as Chair of the Investment Committee.November 2023. Since October 2016,February 2019, he has served as a memberthe Executive Vice President, Chief Strategy and Legal Officer of the board of directors ofThe Duckhorn Portfolio, Inc., a luxuryUS-based wine company, (NYSE: NAPA).where he leads the strategy and legal teams. From November 2012 to November 2017, Mr. Esserman served as a member of the board of directors of Planet Fitness, Inc., a company focused on franchising and operating fitness centers (NYSE: PLNT). From July 2012 to January 2018,2019, Mr. Sullivan was an attorney at Gibson, Dunn & Crutcher LLP, an international law firm. Prior to that, Mr. Sullivan worked as an investment banker in Credit Suisse Group AG’s technology, media and telecom group, where he served on the Boardspecialized in structuring public and private company acquisitions and divestitures. Mr. Sullivan received a J.D. from Columbia Law School and B.A. in economics and politics from St. Mary’s College of Trust of Vanderbilt University. Mr. Esserman received an M.B.A. from Stanford University and a B.S., with top honors, in Computer Science Engineering from the Massachusetts Institute of Technology.California. We believe that Mr. Esserman’sSullivan’s extensive experience in portfolio investmentsmanagement and consumer brandsadvising public companies on a variety of strategic matters make him an appropriate member of our Board.

Dutch Bros Inc.| 2022 Proxy Statement | 19

| | | | | | | | | | | |

| | Blythe Jack

Director

| Age: 47

|

| | |

| Skills & Expertise:

•Brand Marketing Experience

•Senior Leadership Experience

| Committees: Compensation

|

| |

| Class of Common Stock to Elect: Class C common stock

|

|

|

Ms. Jack has served as a member of our Board since August 2021 and a member of the board of managers for Dutch Bros OpCo since October 2018. Since January 2022, Ms. Jack is the Managing Director Emeritus of TSG Consumer Partners, L.P., a private equity company. From 2011 to January 2022, Ms. Jack has served as a Managing Director of TSG Consumer Partners, L.P., a private equity company, where she also serves as a member of the Investment Committee. Since April 2017, she has served as a member of the board of directors of BrewDog plc, a global independent craft brewing company. Since July 2015, she has served as a member of the board of directors of Backcountry.com, LLC, a retail company specializing in outdoor gear and apparel. From June 2016 to March 2021, Ms. Jack served as a member of the board of directors of Canyon Bicycles GmbH, a direct-to-consumer bicycle company. From April 2014 to December 2020, she served as a member of the board of directors of SweetWater Brewing Company, a craft brewing company. From July 2018 to February 2020, Ms. Jack served as a member of the board of directors of Prive Goods, LLC, a designer eyewear company. From October 2012 to August 2016, she served as a member of the board of directors of IT Cosmetics, LLC, a beauty company. Prior to joining TSG Consumer Partners, L.P., Ms. Jack served as a Managing Director of Rosewood Capital, LP, a private equity company. Ms. Jack received a B.A., with honors, in Communication Studies from Vanderbilt University. We believe that Ms. Jack’s extensive experience in portfolio investments and consumer brands and expertise in strategy and management make her an appropriate member of our Board.

Director Skills, Experience, and Background

Listed below are the skills and experience that we consider important for our directors in light of our current business and structure. The directors’ biographies note each director’s relevant experience, qualifications, and skills relative to this list.

Industry Experience

As a high growth operator and franchisor of drive-thru beverage shops, we seek directors who have sufficient knowledge and experience in the consumer products, retail, food, and beverage industries, which is useful in understanding our product development, offerings, and growth strategies.

Financial/Capital Allocation Experience

As a newly public company, weWe believe it is important that we have directors with senior financial leadership experience at large organizations and/or financial equity firms who are experienced in allocating capital to aide our success.

Brand Marketing Experience

We believe it is important for our directors to have brand marketing experience because of the importance of image and reputation in the beverage business as we continue to expand our footprint to become a recognized and respected brand.

Dutch Bros Inc.| 2022 Proxy Statement | 20

Operations & Distribution Experience

As we continue towards aour growth strategy intoof expansion to new markets, we believe it is important for our directors to have experience in large organization operations and varying distribution channels.

Dutch Bros Inc.| 2024 Proxy Statement | 21

Dutch Bros Inc.| 2024 Proxy Statement | 21

Technology Experience

As we continue our growth strategy of expansion to new markets, and providing a unique experience to our customers, the level of technology resources and infrastructure we use becomes more essential. We believe it is important to have directors with technological expertise to provide insight and perspective on these advancements.

Public Company Board Experience

As a newly public company, directorsDirectors that have served on other public company boards offer diverse perspectives with regards to board dynamics and operations, relationships between the board and Dutch Bros Inc. management, and other matters.

Senior Leadership Experience

We believe that it is important for our directors to have senior leadership experience, as they are uniquely positioned to contribute practical insight into business strategy and operations, and support the achievement of strategic priorities and objectives.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Travis Boersma | | Christine Barone | | Thomas Davis | | Kathryn George | | Stephen Gillett | | Ann M. Miller | | C. David Cone | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Sean Sullivan |

| Industry Experience | | ✓ | | Travis Boersma✓ | | | Jonathan “Joth” Ricci | | Shelley Broader | | Thomas Davis | | Kathryn George | | Stephen Gillett | | Charles Esserman | Blythe Jack |

Industry Experience | | ✓ | | ✓ | | | | | | | | | | ✓ | | |

| Financial/Capital Allocation Experience | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | ✓ | | ✓ | | ✓ | | | | |

| Brand Marketing Experience | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | | | | | | | ✓ | | | | ✓ |

| Operations & Distribution Experience | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | | ✓ | | | | | ✓ | | | | |

| Technology Experience | | | | | | | | | | ✓ | | | | | | | | | | | ✓ | | | | |

| Public Company Board Experience | | | | ✓ | | | | | | ✓ | | | ✓ | | ✓ | | | | | ✓ | | ✓ | | |

| Senior Leadership Experience | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

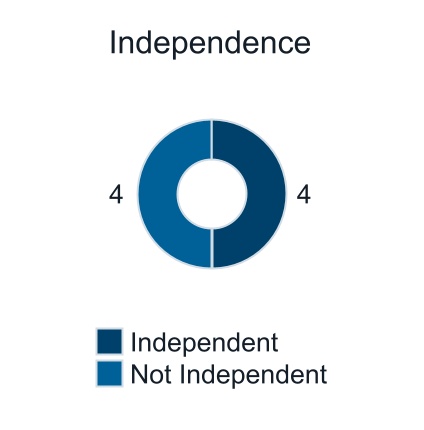

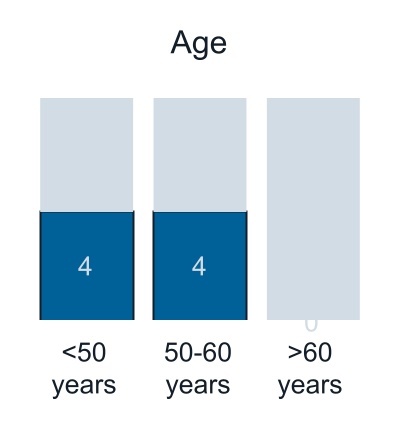

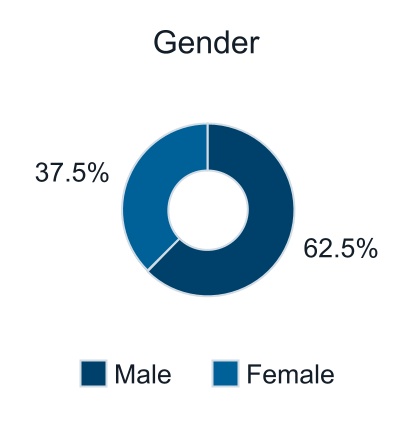

Board Diversity

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 2122

CORPORATE GOVERNANCE MATTERS

Composition of Our Board of Directors

Our business and affairs are managed under the direction of our Board. Our amended and restated certificate of incorporation and our amended and restated bylaws permit our Board to establish the authorized number of directors from time to time by resolution. Each director serves until the expiration of the term for which such director was elected or appointed, or until such director’s earlier death, resignation, or removal.

Our amended and restated certificate of incorporation permits the holders of the Class C common stock, voting as a separate class, to elect up to two members to the Board subject to certain limitations set forth therein. In connection with our IPO, we entered into the Stockholders Agreement with investment funds affiliated with our Sponsor governing certain designation rights with respect to our Board following our IPO. Pursuant to the terms of the Stockholders Agreement, following the completion of our IPO, investment funds affiliated with our Sponsor have the right to designate up to two of the directors serving on our Board.Board, subject to certain limitations set forth therein. Currently, our Sponsor has the right to designate, and the holders of shares of Class C common stock have the right to elect, one director, pursuant to the Stockholders Agreement and our amended and restated certificate of incorporation. See “Other Matters—Transactions with Related Persons—Stockholders Agreement.”

Board Leadership Structure

The positions of Executive Chairman of the Board and Chief Executive Officer are presently separated with Mr. Boersma serving as our Executive Chairman and Mr. RicciMs. Barone serving as our Chief Executive OfficerOfficer. We believe this arrangement at this time allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Executive Chairman of the Board to lead the Board in its fundamental role of providing advice to, anand independent oversight of, management. Our amended and restated bylaws and corporate governance guidelines, which do not require that our Executive Chairman and Chief Executive Officer positions be separate, allow our Board to determine the board leadership structure that is appropriate for us at any given point in time, taking into account the dynamic demands of our business, our senior executive personnel, and other factors.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of Dutch Bros’ risk management process.processes. The Board and its Audit and Risk Committee of the Board administer risk oversight functions to address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination ofdetermining the nature and level of risk appropriate for us. Our Audit and Risk Committee has the responsibility to consideris responsible for considering and discussdiscussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including the guidelines and policies to governgoverning the process by which risk assessment and management is undertaken. The Audit and Risk Committee also monitors compliance with legal and regulatory requirements in addition to oversight ofand oversees the performance of our internal audit function. The Audit and Risk Committee responsibilitiesis also include oversight ofresponsible for overseeing cybersecurity risk management, and, to that end, the committee periodically reviews and discusses with management risks relating to data privacy, technology, and information security, including cybersecurity and backup of information systems, and the steps we have taken to monitor and control such exposures.risks.

Dutch Bros Inc.|

Dutch Bros Inc.| 2022 2024 Proxy Statement | 2223

Our Audit and Risk Committee monitors the effectiveness of our Corporate Governance Guidelines,Code of Business Conduct and Ethics, including whether they areit is successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Typically, the entire Board meets with the head of our risk management group at least annually, and the applicable Board committees meet at least annually with the employees responsible for risk management in the committees’ respective areas of oversight. Both the Board as a whole and the various standing committees receive periodic reports from the head of risk management, as well as incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Controlled Company Exemption

As of April 7, 2022,March 19, 2024, our Co-Founder beneficially owned approximately 74.8%75.8% of the combined voting power of our issued and outstanding Class A common stock, Class B common stock, Class C common stock, and Class D common stock. As a result, we are a “controlled company” within the meaning of the NYSE corporate governance standards. Under these corporate governance standards, a company of which more than 50% of the voting power for the election of directors is held by an individual, group, or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements (1)(i) that a majority of our Board consist of independent directors, (2)(ii) that our Board have a compensation committee that consists entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, and (3)(iii) that our director nominations be made, or recommended to our full Board, by our independent directors or by a nominations committee that consists entirely of independent directors and that we adopt a written charter or board resolution addressing the nomination process. We have elected to take advantage of the “controlled company” governance standards. Accordingly, you do not have the same protections afforded to stockholders of companies that are subject to these corporate governance requirements. In the event that we cease to be a “controlled company” and our shares continue to be listed on the NYSE, we will be required to comply with these provisions within the applicable transition periods.

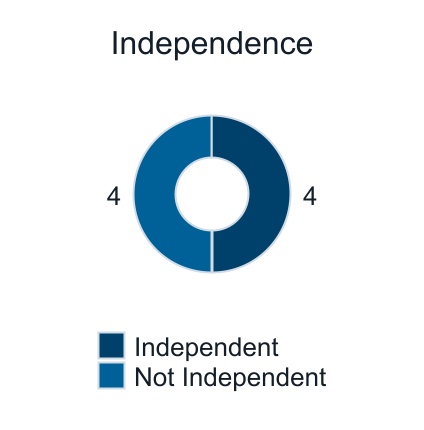

Consistent with the foregoing, our Board has determined that Shelley Broader, Charles Esserman, Stephen Gillett, Ann M. Miller, C. David Cone, and Blythe JackSean Sullivan each meet the independence requirements set forth in the NYSE listing standards and that none of the foregoing have a relationship with Dutch Bros which, in the opinion of the Board, would interfere with the exercise of sound judgment in carrying out the responsibilities of a director. In addition, our Board has determined that Travis Boersma, Jonathan Ricci,Christine Barone, Thomas Davis, and Katheryn George do not meet the independence requirements set forth in the NYSE listing standards due Messersbecause of Mr. Boersma and Ricci’sMs. Barone’s employment by Dutch Bros and the affiliation Mr. Davis and Ms. GeorgeGeorge’s affiliation with BBH, which provides banking services to certain officers and directors of Dutch Bros. In making these determinations, our Board considered the current and prior relationships that each director has with Dutch Bros and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-employee director and the transactions described in the section titled “Other Matters—Transactions with Related Persons—Stockholders Agreement.”

Director Nominations

As a controlled company, we do not have a standing nominating committee. Our Board isand its Nominating and Governance Committee are responsible for nominating members for election to the Board by the Company’s stockholders, subject to the Stockholders Agreement, as described herein in the section titled “Transactions“Other Matters—Transactions with Related Persons—Stockholders Agreement.” As there is no standing nominating committee, we do not have a nominating committee charter in place.

Dutch Bros Inc.| 2024 Proxy Statement | 24

Dutch Bros Inc.| 2024 Proxy Statement | 24

Our Board will consider director candidates recommended by stockholders. Stockholders who wish to recommend individuals for consideration by our Board to become nominees for election to the Board may do so by delivering a written recommendation to our Board at the following address: Dutch Bros Inc., 110

Dutch Bros Inc.| 2022 Proxy Statement | 23

SW 4th4th Street, Grants Pass, Oregon 97526, Attention: Corporate Secretary, in accordance with the timeline outlined in the section titled “When are“How can I submit a stockholder proposals dueproposal or director nomination for next year’s annual meeting?” under the heading “Questions and Answers About Thesethe Proxy Materials and Voting.the Annual Meeting.” Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director, and a representation that the nominating stockholder is a beneficial or record holder of our common stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

In general, in identifying and evaluating nominees for director, our Board considers the board membership criteria further described below. Our Board does not intend to alter the manner in which it evaluates candidates, including the criteria set forth below, based on whether or not the candidate was recommended by a stockholder.

When evaluating director nominees, in the case of incumbent directors whose terms of office are set to expire, our Board reviews these directors’ overall service to Dutch Bros during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, our Boardthe Nominating and Governance Committee uses its resources to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. Our BoardThe Nominating and Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Board also meets to discuss and evaluate the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

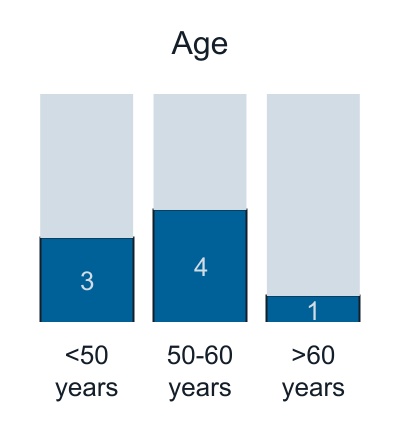

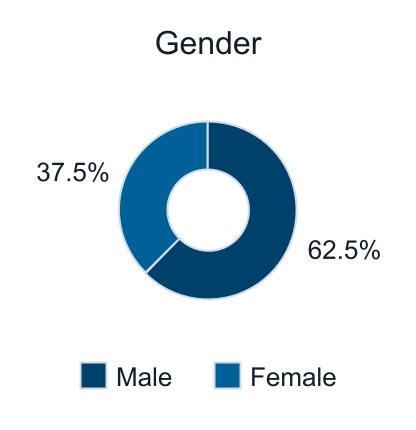

Board Membership Criteria

Our Board has delegated the initial responsibility to recruit and evaluate candidates to its Nominating and Governance Committee. Our Board believes director candidates should have certain qualifications, including being able to read and understand basic financial statements and having the highest personal integrity and ethics. In considering candidates, our Board also considers factors such as: (i) possessing relevant expertise upon which to be able to offer advice and guidance to management; (ii) bringing diverse personal background, perspective, and experience; (iii) having sufficient time to devote to our affairs; (iii)(iv) demonstrating excellence in his or her field, (iv)(v) having the ability to exercise sound business judgment; (v)(vi) experience as a board member or executive officer of another publicly-held company; (vi) having a diverse personal background, perspective, and experience; (vii) requirements of applicable law; and (viii) having the commitment to rigorously represent the long-term interests of Dutch Bros’ stockholders. Ourstockholders; and (viii) the requirements of applicable law. The Board reviews candidates for director nomination in the context of our current composition of the Board, the operating requirements of Dutch Bros, and the long-term interests of our stockholders. In conducting this assessment, ourthe Board considers various factors, including, but not limited to, independence, age, diversity (including race, ethnicity, sexual orientation,diversity of gender, identity, gender expression, age, education,ethnic background and country of origin, and cultural background) and status as a member of an underrepresented community, integrity,origin), age, skills, financial and other expertise, breadthfactors that it deems appropriate to maintain a balance of knowledge, experience, and knowledge about our business or industry.capability on the Board. Accordingly, the Nominating and Governance Committee includes, and has any search firm that it engages include, women and candidates from underrepresented communities in the pool from which the Board selects candidates for director. As part of its periodic self-evaluation, the Board assesses the effectiveness of its efforts to attain diversity by considering whether it has an appropriate process for identifying and selecting director candidates.

Stockholder Engagement and Communications With Thethe Board Ofof Directors

We consider our relationships with our stockholders to be a high priority. We recognize that stockholders can have divergent interests and different views on our practices, objectives, and time horizons. To